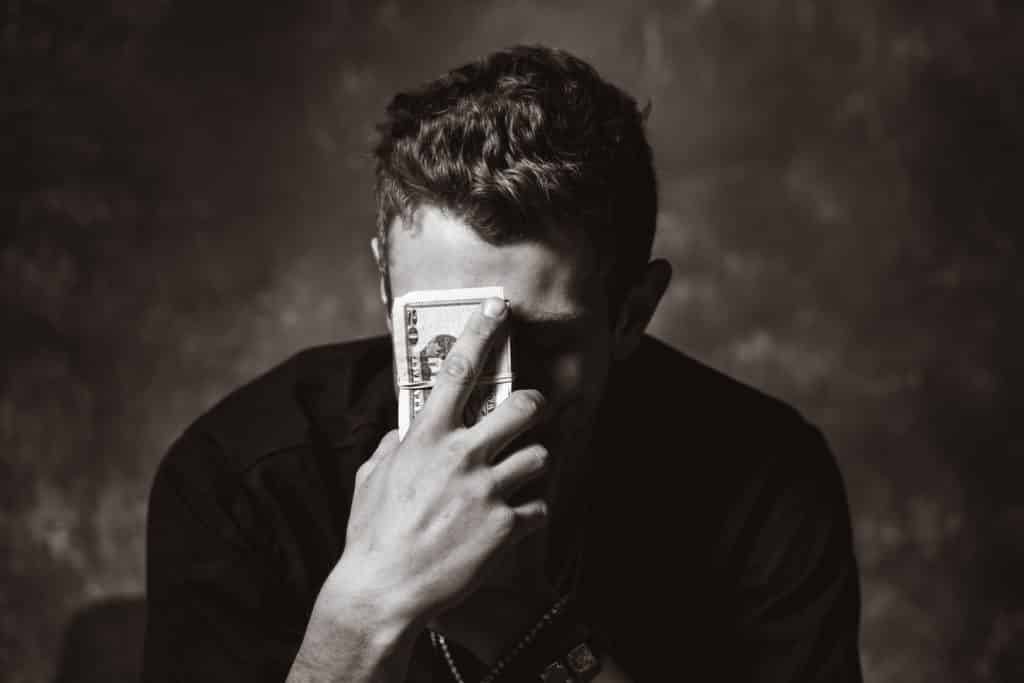

How money affects our mental health and is it significant? In short, yes! It is very important, now more than ever, given the economic landscape caused by Covid-19. Money is arguably the single most important construct for civilizing the modern world. The invention of money has established the consenting relationships between buyers and sellers, but also workers and owners. This medium of exchange is understood across the globe and is the foundation of our society. These small pieces of paper dictate almost every aspect of our lives; perhaps most importantly our mental health.

In 2017 The American Psychology Association conducted a survey named “Stress in America”. This found “money” to be ranked 2nd among prominent stressors for Americans. 1st place belonged to “the future of our nation”, while “work” ranked 3rd. It is no surprise to most that money is on this list. What may be surprising to some is the direct relationship between our mental health and money.

An individual’s financial well-being is one of the greatest indicators of their mental wellness. A study published in 2011 by the peer-reviewed medical journal JAMA Psychiatry, compared mental health with those making under $20,000 per year to those making over $70,000 per year. This research showed that low levels of household income are associated with several lifetime mental disorders and suicide attempts. The study also showed that a reduction in household income is associated with increased risk of incident mental health disorders (anxiety, stress, depression, substance abuse).

In the new Covid-19 world, 15 million people have become unemployed. This has created financial instability on a scale that has been unseen since the Great Depression. With millions losing their jobs every month, it is expected our nation will see millions struggle with mental health disorders.

The trauma of losing a job can be similar to that of losing a close friend or even a loved one. It is normal to feel anxious, sad or stressed in these hard times. Having the right set of tools at your disposal can make all the difference between just a normal “rut” and a serious mental health problem. If you or a loved one has lost a job recently here is a great set of tips that may help.

Debt and Mental Issues

Most abundant debts in America:

- Mortgages: $9.4 trillion

- Credit Cards: $1.08 trillion

- Student Loans: $1.48 trillion

- Car Loans: $1.3 trillion

On average Americans hold $38,000 of debt per capita. Mental health problems can affect our ability to organize and manage debt. This is true even when the root of the mental health issue is debt in the first place. Oftentimes debt and mental health are connected.

Being in debt can evoke emotions of embarrassment, guilt, and grievance. These feelings are amplified depending on the amount of debt, and the amount of time spent in debt. Being in debt can result in depression, anxiety, or stress-related disorders.

Roughly 35% of Americans have one or more debts that are in collections. Meaning, 35% of Americans have their phones ringing off the hooks from debt collectors every day. This harassment itself is a source of stress and anxiety for the debt holder.

Retail Therapy Loop

A common unhealthy practice many people have to cope with poor mental health is called retail therapy. This is the purchasing of material items to temporarily alleviate the burdens that mental illnesses produce.

In extreme cases, an individual will spend money on items they cannot afford which leads them deeper into problem debt. This situation creates a positive feedback loop. As it causes more mental health problems for the spender as debt grows. It then causes them to purchase more and more. Inevitably digging a deeper hole. This practice can be called stress spending, manic spending, depression spending, etc.

Money and Happiness

“Money can’t buy happiness” – although it is cliche, it remains true. Being rich will not necessarily make you happier. But It will increase your standard of living, and evaluation of life. What can help make an individual happy is making good financial decisions.

Your financial situation and mental health go hand-in-hand. If you are able to keep yourself from needlessly facing major financial issues, you are less likely to face mental health issues.

10 Tips to Take Control of Your Finances & Mental Health

- Create a Budget: Know your income and restrict your spending by paying more attention or using a budgeting tool.

- Make Dinner at Home: Spending money eating out is one of the most expensive luxuries a household can subject themselves to. The grocery store is a much cheaper alternative.

- Exercise: Participating in some kind of physical health activity an hour each day is one of the most beneficial things you can do for your mental health.

- Sleep: Getting too little or too much sleep can be detrimental to your mental health. Being able to sleep for 7-8 hours will improve your overall quality of life.

- Talk with a Financial Advisor: A financial advisor gives you access to expert advice on how to deal with money problems. They can help you manage your budget and help with a plan to become financially healthy now and in the future.

- Put the Credit Cards Away: Use cash or debit card when possible to elimiate debt build-up.

- Try to Cut a Deal with Debt Collectors: Never pay the full amount of debt if it has gone to collections. You can make a deal with the collector which often results in you paying less than 50% of the original amount.

- Meet with Family/Friends: Humans are naturally social creatures, so socializing with those close to you will help stabilize mental health issues.

- Refrain from Drinking/Smoking: Too often do people with mental health problems cope with drinking/smoking. This can make mental health problems worse and can lead to chemical dependancy or worse, addiction.

- Seek Help from a Professional: The mind can often seem like a complex puzzle that is missing the corner pieces sitting on a table in the middle of the room. Sometimes it’s best to receive help from trained professionals.

Citations

Kahneman, D., and A. Deaton. “High Income Improves Evaluation of Life but Not Emotional Well-Being.” Proceedings of the National Academy of Sciences, vol. 107, no. 38, 2010, pp. 16489–93. Crossref, doi:10.1073/pnas.1011492107

Ratcliffe, Caroline. “Delinquent Debt in America.” Urban Institute, 28 July 2014, www.urban.org/research/publication/delinquent-debt-america/view/full_report

Sareen J, Afifi TO, McMillan KA, Asmundson GJG. Relationship Between Household Income and Mental Disorders: Findings From a Population-Based Longitudinal Study. JAMA Psychiatry. 2011;68(4):419–427. doi:10.1001/archgenpsychiatry.2011.15

Smith, Melinda, et al. “Job Loss and Unemployment Stress – HelpGuide.Org.” Help Guide, Apr. 2020, www.helpguide.org/articles/stress/job-loss-and-unemployment-stress.htm

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]